Understanding the “bảng kết quả kinh doanh tiếng anh,” or financial statements in English, is crucial for anyone navigating the business world, whether you’re an investor, entrepreneur, or simply a curious football fan looking to understand your club’s finances. This guide will break down the key concepts and terminology, ensuring you can confidently analyze these vital documents.

Diving Deep into Financial Statements: More Than Just Numbers

Financial statements offer a snapshot of a company’s financial health, providing a wealth of information about its performance, profitability, and stability. They are essential for making informed decisions, from investment strategies to business planning. Think of it as analyzing a football team’s performance – you need more than just the final score to truly understand their strengths and weaknesses.

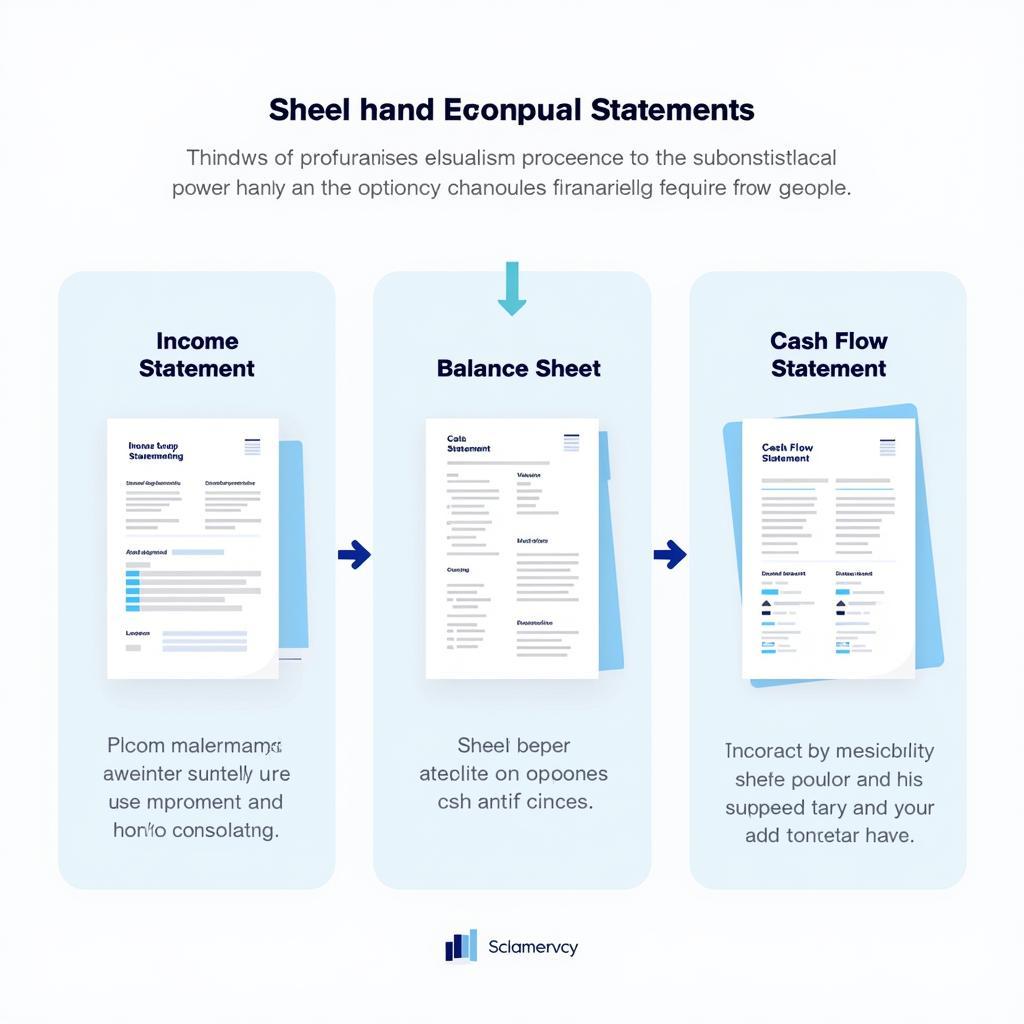

The Income Statement: Tracking the Flow of Revenue

The Income Statement, often called the Profit and Loss (P&L) statement, reveals a company’s financial performance over a specific period. It tracks revenues, expenses, and ultimately, the net profit or loss. Just like tracking a football team’s goals scored versus goals conceded. Want to know if your team (or company) is winning? The Income Statement is where you look. kêu gọi đến xem bóng

Key elements of the Income Statement:

- Revenue: The total income generated from sales.

- Cost of Goods Sold (COGS): Direct costs associated with producing goods or services.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs incurred in running the business, such as salaries and rent.

- Operating Income: Gross profit minus operating expenses.

- Net Income: The final profit after all expenses and taxes are deducted.

The Balance Sheet: A Snapshot of Financial Position

The Balance Sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It’s like a team photo – it shows you who’s on the field (assets), who they owe money to (liabilities), and who owns the team (equity). This helps you understand the company’s financial strength and stability. ví dụ về báo cáo kết quả kinh doanh

The Balance Sheet Equation: Assets = Liabilities + Equity

The Cash Flow Statement: Where Did the Money Go?

The Cash Flow Statement tracks the movement of cash both into and out of a company during a specific period. It’s like tracking the transfer fees and player salaries in football. Understanding cash flow is critical to assessing a company’s ability to meet its financial obligations.

Three main sections of the Cash Flow Statement:

- Operating Activities: Cash flow from the core business operations.

- Investing Activities: Cash flow related to investments in assets.

- Financing Activities: Cash flow related to debt, equity, and dividends. bảng kết quả tiếng anh là gì

Mastering Financial Terminology

Understanding the language of financial statements is key to effective analysis. While many terms are similar in both English and Vietnamese, grasping the nuances can significantly enhance your understanding. bao cao kết quả 3 chu dong

Expert Insight: “Financial statements are the storytellers of a company’s journey. Learning to read them is like unlocking a secret code to understand their past, present, and potential future,” says Dr. Anh Nguyen, a renowned financial analyst.

Conclusion: Bảng Kết Quả Kinh Doanh Tiếng Anh – Your Key to Financial Literacy

Mastering the “bảng kết quả kinh doanh tiếng anh” is essential for informed decision-making in the business world. By understanding the key components of financial statements and their underlying terminology, you gain valuable insights into a company’s financial health and prospects.

FAQ:

- What are the main types of financial statements?

- What is the purpose of an Income Statement?

- How does a Balance Sheet differ from a Cash Flow Statement?

- What are some key financial ratios used in analyzing financial statements?

- Where can I find a company’s financial statements?

- How can I interpret financial statement trends?

- What are some common red flags to look for in financial statements?

Other helpful resources on XEM BÓNG MOBILE: bạn có hài lòng với kết quả hiện tại

Need assistance? Contact us at Phone: 0372999996, Email: [email protected] or visit our office at 236 Cầu Giấy, Hà Nội. Our customer service team is available 24/7.